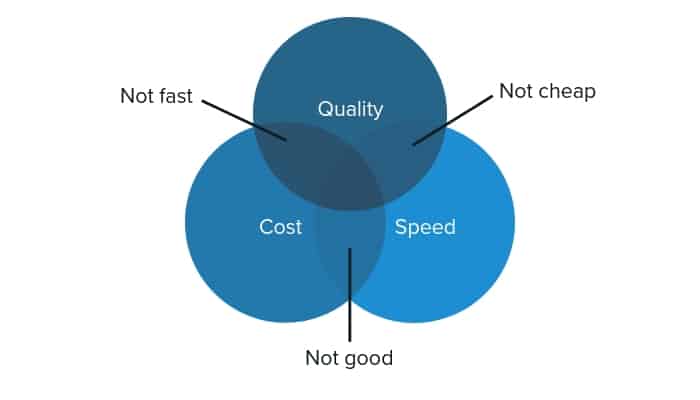

You will have probably seen the good, fast, cheap triangle.

The dilemma is that you can only choose two. You’re forced to choose speed, quality or cost. Something that is good and cheap will not be fast. Cheap and fast, not good. Good and fast, not cheap.

This is true when it comes to hiring and recruitment metrics.

This is why we have divided your most common recruitment metrics into three categories: speed, quality, and cost.

It is possible to have a recruitment process that is quality-oriented, quick, and cost-effective. But achieving this for your business requires balance, and it requires an assessment of your current situation. And this includes monitoring key recruitment metrics in your hiring.

If you’re passionate about constant improvement - whether that’s the process, candidate experience, or employer brand - become obsessed with your recruitment metrics.

Here we’ll share the 19 most common recruitment metrics used across hiring teams.

- Time to hire

- Time to accept

- Time to start

- Time to inform

- Time per stage

- Submission to acceptance rate

- Source of hire

- Applications per job

- Candidates per hire

- Retention

- Offer to acceptance

- Application completion

- Hires per channel

- Contact rate

- Candidate experience

- Cost per hire

- Applications per channel

- Talent pool growth

- Advertisement performance

Speed-based recruitment metrics

Lack of time is often one of recruiters’ and hiring managers’ biggest complaints. The longer candidates spend in each stage of the recruitment process, the more time recruiters need to spend on communication, coordination and balancing workloads between multiple processes.

Time is also one of the largest sources of poor candidate experience: “the hiring process took too long” or “the recruiter didn’t get back to me for weeks” are often heard in candidate reviews.

Optimizing the time spent on various stages of the hiring process is a prerequisite for improving your team’s efficiency and improving the candidate experience.

Time to hire

Time to hire is one of the most standard measurements within the recruitment process. It’s intended to give your team a good indication of how long it takes between the start of the recruitment process and when a candidate is cleared to start work.

The clock starts when one of the following applies:

- a candidate applies to an open role;

- a candidate is approached for a role and agrees to be considered;

- an existing employee is recommended/applies to the role;

- an employee referral is received.

The clock only stops when a candidate has accepted the offer and cleared any reference or background checks.

Time to hire is a fundamental hiring metric that can be used to improve the efficiency of your team. However, as a macro metric, looking at the entire process, it has limited capacity to tell you exactly which parts of your hiring process need improvement.

Time to hire can also be segmented to compare time to hires of existing employees, employee referrals, candidates who applied online, and headhunted candidates.

Differences can highlight any discrepancies between your team’s approach to different kinds of candidates.

Time to accept

Time to accept is the measurement of how long it takes a candidate to consider your offer and formally accept the position. The clock begins when the business has approved the offer and stops only when the candidate has formally accepted the offer. For different companies, formal offer acceptance can be either verbal or written.What should be noted about this hiring metric is that it does not include candidates who have rejected the offer.

Time to accept is a great metric to use to gauge the effectiveness of your recruitment team’s pre-closing techniques and control over the hiring process. It can help indicate whether you need to spend more time addressing candidate concerns regarding the position, salary, benefits or other vital details prior to the offer.

Addressing candidate concerns ahead of the offer (and sometimes coming to an informal agreement) can help cut the time to accept and increase the likelihood of acceptance.

Time to start

Time to start tracks the length of time between a candidate’s formal acceptance and their first workday at your company. This is measured to supplement time to hire.

When looking at a lengthy or an unsatisfactory time to hire, time to start can indicate issues with candidates’ notice periods rather than the speed of the recruitment process.

Time to inform

Time to inform is a good metric to use if you are looking to improve your candidate experience. It is also a more complex metric that should be divided out into time to disqualify and time to approve.

Time to inform is measured by the average length of time from completion of the most recent step in the hiring process to the informing of a candidate- whether they have been rejected or approved for the next step.

Most recent steps could include:

- application;

- phone screening;

- interview;

- assessment;

- or trial day.

Time to inform should be split out by the last completed stage to help your team optimize the candidate experience.

Used generally it will indicate how speedy your internal decision making is regarding candidates’ progress in the hiring process and how prompt your communication is. If split into the outcome of the candidate, it can shed further light on the candidate experience.

Time to disqualify

The average time to disqualify, or give a candidate a negative response, is important. Short times to disqualify can indicate a poor candidate experience; no one likes being told directly after an interview that they’ve been unsuccessful or receive an automated rejection email only hours after applying). Similarly, long times to disqualify, especially for the stages after application, can generate a poor candidate experience; no one wants to wait a month with no news after completing an interview.

Time to disqualify is not commonly used but can be a very powerful tool in demonstrating where you may be failing to inform candidates or informing them with little sensitivity.

Time to approve

The average time to approve should also be monitored for times that become too long. Long times to approve at various stages of the hiring process can indicate a poor candidate experience; no candidate wants to be left wondering if they are going to come in for a second interview.

Additionally, this metric may be able to indicate bottlenecks in your internal decision making process or potential risk areas where candidates may drop out as they’re offered other positions or lose interest.

Time per stage

Another variation on time to inform is the tracked time per stage. Time per stage is calculated by counting from the date that a candidate enters or is moved to a certain stage, to the date that they are either rejected or moved to the next stage. For example, if you would like to measure the average time spent in the first interview you would start counting from the date that the invitation is extended to the time that candidate is moved to the next stage or rejected.

Time per stage can be used to identify inefficient processes or decision making stalemates at various stages of your hiring process. Furthermore, like time to inform, it can help shed light on areas where you may be losing candidates.

Other speed-based recruitment metrics

Traditionally, some companies have measured HR to business time allotment. This is an old metric that was used to gain visibility over the time spent by hiring managers and HR on the hiring process. HR’s time would start when the job was registered with the HR department and would end with passing the process on to a hiring manager at the interview phase. Businesses’ time allotment would begin with the interview process and end with a decision made.

This is no longer a metric that should be used, as collaborative hiring increases within organizations and lines between involvement within the hiring process are blurred. Furthermore highlighting the division between HR and the business could reinforce outdated perceptions of the relationship between HR and the rest of the business.

Quality-based recruitment metrics

The quality of your candidates, onboarding, job offers, and advertisement is important to monitor for sustainability.

If the quality of your hiring process is low, then your team will:

- Waste more time sourcing candidates than hiring.

- Spend more time interviewing poorly-suited candidates.

- Struggle to actively attract the right candidates to your business.

Quality recruitment metrics can help you identify areas that require optimization in order to save your recruitment team valuable time spent in the hiring process.

With less time spent on unsuccessful candidates, underperforming talent acquisition channels and poor communication, your team will be freed up to connect with the talent that can drive your business.

Submission to acceptance rate

The submission to acceptance rate is a recruiting metric that is commonly used in agency recruitment models that could be replicated to an in-house context.

Submission to acceptance measures how many candidate profiles are presented to the hiring manager compared to how many of those profiles are found suitable for interview. Submission to acceptance rate has the power to indicate the accuracy of the recruiter.

This ratio can help businesses appraise hiring manager selectivity and recruiter accuracy. Using this metric to inform dialogue between hiring managers and recruiters can help build a collaborative hiring process.

Submission to acceptance rates can show the need for:

- a more accurate job spec;

- more advertisement budget for improved candidate profiles;

- maximized or paired down outreach on social channels for better responses;

- or improved job descriptions.

Source of hire

Source of hire can be a helpful data point to collect in order to begin predicting your best talent acquisition channels. This hiring metric can be tracked by tagging each candidate who is submitted to your hiring process with a tag detailing the acquisition source, or where the recruiter found the profile (LinkedIn, Employee referral, Internal, Facebook, Indeed etc).

By tracking this data, you can then look at successful hires. Then you can assess which acquisition channels have resulted in the best quality hires.

Applications per job

Applications per job is probably one of the most basic quality metrics used by most recruiters, however, it can be a good indicator for the quality of advertising efforts.

This metric measures the number of applications received per individual job posting throughout the time that the position is live and advertised openly. In the case of a low number of applications per job, this metric can help teams identify issues with the job description.

Poor quality job descriptions will consistently fail to attract candidates. Alternatively, a low number of applications per job could show that you may not be using the appropriate job boards or social channels to attract the necessary talent.

Experimenting with either of these areas while monitoring applications per job can help you optimize your talent acquisition strategy to attract relevant talent.

Candidates per hire

Candidates per hire is a quality metric that extends across multiple roles and can lend insight into the general quality of your recruiting efforts.

This hiring metric is measured by comparing the total number of candidates that are processed across your open roles in a set period (phone screening / first stage onwards) versus the number of successful hires that were made in that same period.

By measuring candidates per hire, you can get a good sense of how many candidates your business must process in order to produce one hire. This is a metric that should be monitored and optimized. The number of candidates per hire will give you an indication of how much money is required to recruit, as each candidate represents time spent by a recruiter or an HR team member.

Additionally, this metric can be segmented according to role or department to assist in pinpointing the source of the issue.Inevitably, there will be some businesses where candidates per hire remain high due to the nature of the positions or candidate markets.

Retention

Retention rates are a great metric to indicate the quality of hires. This indicator is measured in time blocks and will track the number of hires (that start work at your company) and record how many of these new starters are still working with you six months later, a year later, and so on. High retention rates suggest that the candidate attraction strategy, selection process, and onboarding is generally healthy.

Poor retention rates can indicate a number of issues including:

- poor candidate selection;

- insufficient onboarding;

- unsatisfactory working conditions.

If retention rates are segmented according to the reason for the employee leaving- the employee decided to leave themselves or the company terminated the contract- they can shed better light on the issue in the hiring process.

Using the numbers of employees terminated due to poor skills, or cultural fit, you may be able to better pinpoint the issue in the candidate selection process. Monitoring the number of candidates who leave by their own choice, can indicate that your onboarding process may be lacking or the work conditions may not be suitable.

Retention rates are important to monitor and evaluate as they raise red flags as hard-earned candidates leave the company, thus revealing sunken costs within the recruitment process.

Offer to acceptance

Offer to acceptance is a good quality metric to judge the quality of your hiring process and offer. Offer to acceptance compares the number of candidates offered a position to the number of candidates that accept the offer. An offer can be verbal or written.

Low offer to acceptance rates may reveal problems lurking in your hiring process that may have discouraged the candidate from accepting. It could also indicate poor quality offers or poorly matched candidates- salary expectations not met, the role not suitable to skills or company not matched to profile.

Alternatively, a high offer to acceptance rates indicates a healthy recruitment process and high success rates.

Application completion

Application completion helps assess the candidate experience during the application phase. It measures the number of candidates who start the application process and either drop off or submit a full application. A high number of drop-offs will result in a low application completion rate.

This can help flag issues regarding the length, quality, and general experience of the application process.

Hires per channel

Managers often want to know where the best hires come from in order to find their next great hire. Accurately tracking hires per channel will help reveal the sources of some of your best hires and help you assess which channels are producing the best results.

Map out your active channels that are currently generating candidate applications such as:

- Internal candidates;

- employee referrals;

- careers site;

- your talent pool;

- social (divide out by platform like Xing, LinkedIn, Facebook or Instagram);

- or job boards (divide out by board like Monster, Indeed, AngelList).

As applications come in through your ATS, make sure to tag them with the source they came from. When it comes to the candidates you have successfully hired, if you have tagged all applications with the channels they originated from then you will be able to determine hires per channel. This will give you the number of successful hires from all of your active channels.

Comparing each channel will help you make more informed decisions on where you would like to invest more effort to sourcing your best quality candidates.

Contact rate

Communication is a cornerstone of the recruitment process and there are so many points where it can be measured. Contact rate can be a helpful way of monitoring the quality of candidate experience that you offer. When candidate applications come in, you can monitor how many candidates out of the total number of applicants have already been contacted at any given time. This is an important metric to monitor quality candidate experience, as low contact rates will unveil a large number of candidates who never received responses to their applications.

Candidate experience

Until recently, the candidate experience was difficult to measure. But with the introduction of NPS (Net Promoter Scores) and questionnaires, it’s now easy to capture candidate impressions of your hiring process. When you approach candidates- both successful hires and unsuccessful candidates- make sure you ask them questions around:

- Quality

- Speed

- Communication

You might adapt typical NPS questions (using a one to ten rating) to your hiring process, like:

- Would you apply again to another similarly suitable role with our company?

- How likely are you to recommend us to a friend?

- How was the quality of your [phone screening, interview, assessment]?

- Can you rate the communication of our hiring team?

Approaching successful hires for feedback on the recruitment process is relatively straightforward as they work for your company. But gathering feedback from unsuccessful candidates is equally if not more important yet requires tact. Not every candidate will be happy about the result of the hiring decision. Make sure to leave some time between rejection and sending an NPS questionnaire.The candidate experience is an important value to monitor. And candidate NPS can be a great quality metric to shed light on the hiring experience you offer.

Cost-based recruitment metrics

Optimization when it comes to cost is getting the best value and quality for the least amount of money. But without the right numbers in one central (accessible) place, it is difficult to drive results. Additionally, monitoring cost metrics will help your team assert their value in the company. Here we’ll share some of the most popular cost recruitment metrics you can track.

Cost per hire

Cost per hire is a standard metric to track in order to report on the cost of recruiting new team members. However, collecting all of the necessary information can be difficult to do on a monthly basis. Traditionally, cost per hire is calculated on a yearly or bi-yearly basis and adds up the following costs within that set timeframe:

- Salaries and bonuses of recruiters/HR personnel working on the requirements.

- Advertisement spend on sourcing and employer branding.

- Job board payments.

- Cost of your ATS.

- Costs of any sourcing tools used by your team.

- Candidate assessment costs (if external).

- LinkedIn premium accounts.

- Costs of an employee referral program.

- Payments for any external agency recruitment support.

Divide the total cost by the number of successful hires made that year. This will give you the cost per hire.

Applications per channel

Monitoring the quality of applications generated by each of your channels with hires per channel is important to determine which channels deserve more or less attention. But more importantly, tracking the cost per application will help inform your decisions financially.Use the same list of channels as your hires per channel metric, including:

- Internal candidates;

- employee referrals;

- careers site;

- your talent pool;

- social (divide out by platform like Xing, LinkedIn, Facebook or Instagram);

- or job boards (divide out by board like Monster, Indeed, AngelList).

Application per channel only measures the volume of applications per channel. However, if you know how much you are spending on advertising, you can easily calculate the cost per application.

Talent pool growth

Sourcing qualified candidates cost time and money. Which is why building your own talent pools can be a great way of reducing those costs. But growing a talent pool rarely happens on its own. Sort candidates by role, skill set or location to make the most of your talent pools. Monitor and track the talent pool growth in order to show your sourcing cost savings. And help create an internal talent base.

Social metrics

Social recruitment is changing the way many recruiting teams work and it will continue to be a massive acquisition channel. When you use your social channels well, they can be an effective and free source of candidates. Social engagement is a good indication of how well your channels are performing, the success of outreach, and overall reach. Social engagement can be collected from various channels in different ways. Below are the recommended recruitment metrics for the three main social channels:

- LinkedIn: social engagement and impressions.

- Facebook: post engagement and reach.

- Twitter: Tweet impressions and profile visits.

Remember to collect and compare social metrics in the same time frame (i.e. month, quarter or year). By monitoring your social metrics, you will be able to more accurately gauge and optimize your potential reach. Ultimately this will help you cut down on paid acquisition channels.

Advertisement performance

Many recruiters run paid ads on major social channels to attract talent to apply for open vacancies. Additionally, there may be long-term ads running on employer branding highlights in order to promote your company brand. It’s important to ensure a healthy ROI on any additional recruitment expense.Make sure you’re tracking the performance of any ads you may be running so that you can build up data to compare ads against one another. Compare how many applications were generated as a result of ads. Then calculate your acquisition cost: how much was spent on the advertisement divided by the number of applications produced by this ad.

Tracking your recruitment metrics

There are countless metrics that can be tracked in your hiring process. From time to hire to retention rates, you could spend a good deal of your work week processing all the details. The key here is not to track all of these metrics, but rather select a few and focus on these.But like most things data-driven, there are tools to help you along the way. This is why Recruitee values and offers strong reporting features for hiring teams. Whether you’re looking to start impacting your time to hire or identify your best hiring departments to replicate results, Recruitee’s reports can help make the process easy:

If you’re new to hiring metrics, choose metrics that you have the capacity to start measuring consistently- and perhaps even begin to impact. For those familiar with collecting data points across your hiring, consistency is key. Building more qualitative assessments into why your metrics look the way they do can take your reporting- and ultimately results- to the next level.